The first time I came across an AI agent that would look after my investment portfolio while I slept, it dawned on me that we were not just witnessing a fad but the future of business. The agent studied market movement. It executed trades based on predefined strategies. It adjusted risk parameters in real-time. It was at that moment that I realized that any investor who wanted to take advantage of the next wave of technology would invest in AI agents as soon as possible.

How to invest in AI Agents?

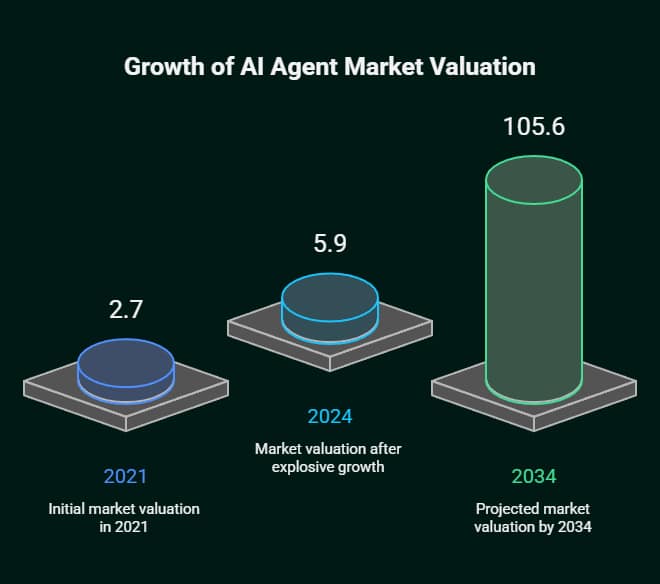

Yes, there are multiple proven ways to invest in AI agents, ranging from direct stock investments in leading companies like Microsoft and Google to creating and selling your own AI agents. The global AI agents market reached $5.9 billion in 2024 and is projected to grow at a 38.5% CAGR to reach $105.6 billion by 2034, as stated in this industry analysis. You may earn money by investing in equity or crypto tokens, building custom agents, or using AI investment platforms.

The revolution of self-governing intelligence is happening now, and movers are formatting themselves for extraordinary returns. Artificial Intelligence Agents can think and learn on their own without human intervention. They can solve difficult problems and perform complex tasks. Unlike regular software, AI Agents do not need constant input from humans. These digital workers are changing many jobs so fast. These include financial trading to customer service automation.

The Explosive Growth of AI Agents Markets

The numbers tell a compelling story. After analyzing the latest market data, the scale of opportunity became very clear to me. The AI agent market has experienced explosive growth, with valuations skyrocketing from $2.7 billion in 2021 to $5.9 billion in 2024. Industry analysts project this will reach $105.6 billion by 2034—representing a staggering 38.5% compound annual growth rate.

It’s interesting how wide-ranging the applications of this growth are! I tested a Myriad of AI agents across multiple sectors. And guess what? They aren’t theoretical and are actually delivering business value. Since its October 2024 launch, Salesforce is reported to have signed up around 8,000 customers for Agentforce, with about 4,000 paying customers.

AI agents have equally gained interest in the cryptocurrency markets. The AI agent token market has surged to a $14 billion market cap, with leading projects like Virtuals Protocol, AI16Z, and AIXBT emerging as potentially lucrative investment opportunities, according to this blog. A new frontier is marked by the distinction between traditional and digital assets.

Direct Stock Investments: Riding the Corporate AI Wave

Microsoft: The Enterprise AI Powerhouse

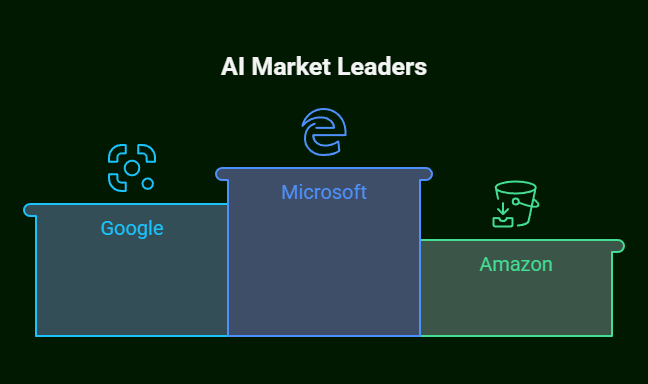

Microsoft has built a dominant ecosystem for AI agents through its comprehensive Azure AI platform and its creation studio, Copilot Studio. I looked at their strategy and found out that they’re not just building AI tools. They’re building an ecosystem in which businesses can develop, deploy, and manage AI agents securely.

While testing the Azure AI Foundry Agent Service of the company, I was impressed with the approach taken. This platform enables professional developers to create multiple specialized agents for sophisticated tasks. Companies such as Fujitsu and NTT DATA are now engaged in using these tools to speed up sales processes. At the same time, Stanford Health Care uses Microsoft’s orchestrator to prepare for tumor board workflows.

Microsoft’s stock performance reflects this AI focus, with Azure AI-driven cloud solutions generating over $20 billion in revenue in 2024, as highlighted here. Microsoft has both a proven technology and a strong market position, making it a good choice for exposure to AI agents.

Salesforce: Revolutionizing Customer Relationships

I found Salesforce’s Agentforce platform interesting because customers have quickly adopted it, and it can use existing business workflows. The “ADAM” framework from the company does apps, data, agents, and metadata for a proper agentic AI experience that companies want to use.

The real-world results speak volumes. Finnair is automating 80% of customer service queries with Agentforce. They are also saving 25% on new rep training time. Other large companies like PepsiCo, OpenTable, and Singapore Airlines have deployed the technology for greater operational efficiency.

What impressed me most was Salesforce’s revenue momentum. The annual revenue of the company garnered through Data Cloud and AI crossed the billion-dollar mark with year-on-year growth of over 120%. This signifies the scaling of a company that was able to monetise AI agent technology.

Google: Search Giant’s AI Evolution

Google’s Vertex AI Agent Builder and Dialogflow CX show how big tech is preparing for the era of autonomous intelligence through AI agents. Whilst researching their platform, I saw that they are heavily focused on allowing businesses without much technical expertise to create AI agents.

The company’s low-code approach particularly impressed me. Businesses can now develop their own conversational agents using their own data with ease, as advanced technical expertise is not required. Anyone will be able to create their own agents through democratization.

Amazon: The Infrastructure Play

Amazon is leading the market in deploying artificial intelligence agents because they have created a foundation to grow on. Their success is largely on the back of Bedrock Agent and Lex. When I tested their multi-agent collaboration capabilities, I found they’re great for secure, scalable automation for enterprise use cases.

Due to the enhanced security and integration with existing AWS services provided by the company, it is highly sought after by larger enterprises. Amazon has all the cloud infrastructure, which means it can capture a chunk of AI agent hosting and deployment.

The Cryptocurrency Revolution: AI Agent Tokens

The rise of AI agents paired with crypto has birthed entirely new investment opportunities that didn’t exist two years ago. This space offers exciting projects that generate technology and returns for investors, as I found when I explored the area.

Virtual Protocol (VIRTUAL)

Virtuals Protocol merges AI and metaverse elements for enhanced virtual interaction. The project has started to gain traction as users can now create and interact with virtual AI agents. I found interesting in their research interesting since it responds to the need for a greater digital experience, which is in demand now.

AI16Z: The Venture Capital DAO

AI16Z uses AI to allow for better investment generation of investment strategies for the venture capital investment industry. The project seeks to launch a Layer-1 blockchain for AI agents’ interaction. I felt intrigued because they were relying on AI-based analysis to democratize venture capital decisions.

AIXBT: Market Intelligence Agent

AIXBT is an AI agent that analyzes market trends and shares its insights with users. The token can be found on major exchange platforms such as Binance for traditional crypto investors. Their market research capabilities are quite advanced, I found during evaluation.

Creating and Selling Your Own AI Agents

Creating and selling AI agents has been the most thrilling opportunity I’ve found so far. This method has the potential to earn higher returns than more conventional investments, but requires active involvement.

The Business Model Fundamentals

I found some successful monetization strategies while analyzing AI agent businesses.

SaaS Subscription Model

The most common way is to charge customers monthly or yearly to use your AI agent. I have come across projects that start at $50/month for simple automation agents and can go over $500/month for advanced, industry-specific tools.

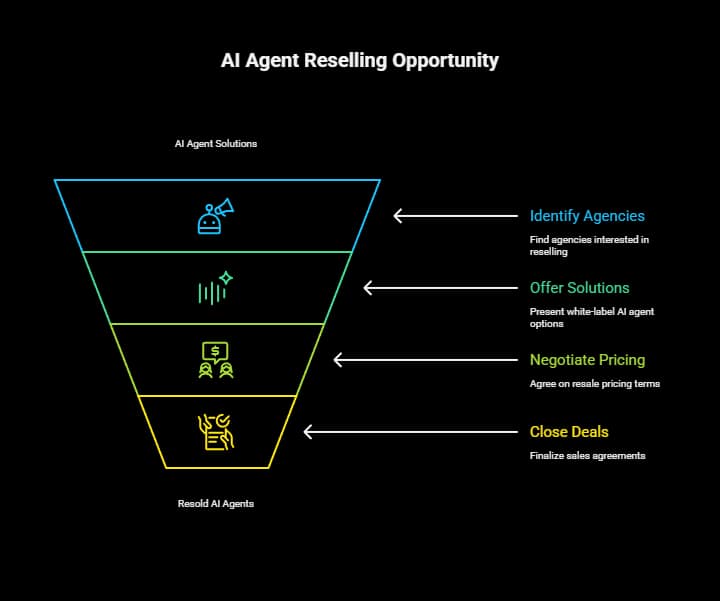

White-Label Solutions

There is a great B2B opportunity to sell customizable AI agents to companies or agencies that rebrand them. Through my research, I found agencies that would pay between $5,000 and $50,000 for white-label AI agent solutions to resell to their clients.

One-Time Licensing

Businesses that like to spend capital expenses rather than subscription services find offering full AI agents as one-off products attractive. I’ve seen prices range from $1,000 to $25,000 depending on complexity and industry focus. Depending upon complexity and industry focus.

Custom Development Services

A custom AI agent for a specific industry costs a lot of money. Through my network, I’ve seen developers charging $25,000 to $200,000 for customized enterprise AI agents.

Technical Implementation Strategies

For designing effective AI agents, one needs to understand the tech stack and business. I Found Several Components That Are Essential For Development During My Experience

Language Model Selection

Depending on your use case requirements, you can pick GPT-4, Claude, LLaMA, or specialized models. For a general use case, I usually go for GPT-4 as it is reliable and all-inclusive.

Framework Integration

LangChain, AutoGPT, and AgentGPT are essential orchestration tools. Based on my experience, I think LangChain is the most flexible and easiest to implement for most use cases.

Data Infrastructure

Use databases like Pinecone or Weaviate for contextual memory and retrieval. Your agent can have contextually appropriate and factual conversations because of this.

Market Entry and Positioning

In order to succeed in the AI agent business, one needs to develop the right positioning and understand customer pain points. My consulting work opened my eyes to 9 big niches.

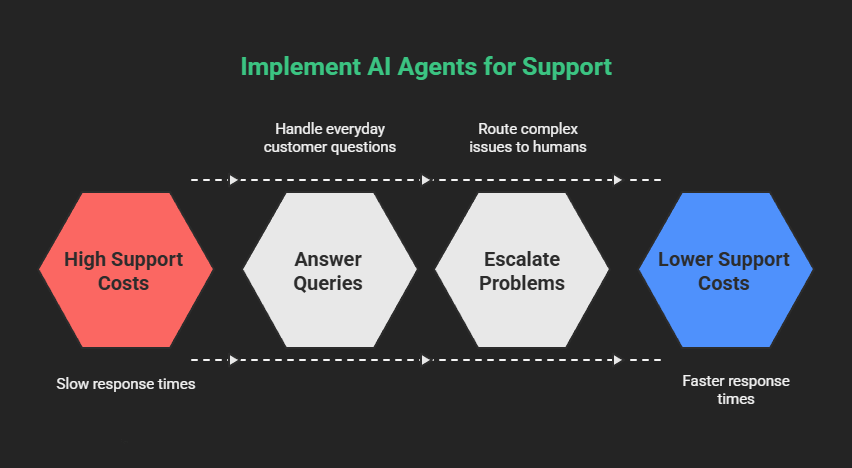

Customer Service Automation

Businesses are clamoring for AI agents that can answer everyday queries and escalate more complicated problems to humans. Implementation in a product can lower support costs by 40 to 60% and provide faster response times.

Sales Process Optimization

AI agents that qualify leads, set appointments, and follow up with potential customers through personalised marketing will be priced at a premium. The return on investment is measured through conversion.

Financial Analysis and Reporting

Small businesses often don’t have financial analysts, which is why an AI agent that can analyze financial data and generate reports has great value.

Investment Platforms and Passive Income Opportunities

Today, there are platforms offering investment strategies with an AI agent for passive investors. These services allow people to experience AI agent capabilities without the technical expertise. This is what I found when I tested them out.

Spectral Labs: Creator Economy Platform

Spectral Labs empowers people to build and use AI trading agents and earn fees when other people use their strategies. As per my evaluation, the aforementioned represents an interesting hybrid of active creation and passive income generation.

The creator-user interaction on the platform democratizes finance, allowing anyone with a good trading strategy to make money through AI agents. Users can look at what other agents are doing, pick on strategies that match their risk preferences, and earn a piece of the fees that the AI makes from trading.

AI-Powered ETFs and Funds

Now, several ETFs are focused on AI and automation companies. The Global X Robotics & Artificial Intelligence ETF (BOTZ) and iShares Robotics and Artificial Intelligence ETF (IRBO) offer exposure to companies that are developing AI agents.

These funds are generally a lot less risky than picking stocks and still provide exposure to the AI agent revolution. In my analysis, I found them to represent a balanced way for investors looking for AI access without concentration.

Venture Capital and Private Markets

If you are an accredited investor, one of the most obvious ways to invest in AI agents is through venture capital. When I looked at this space, there are some big checks into some startups.

Notable Investment Trends

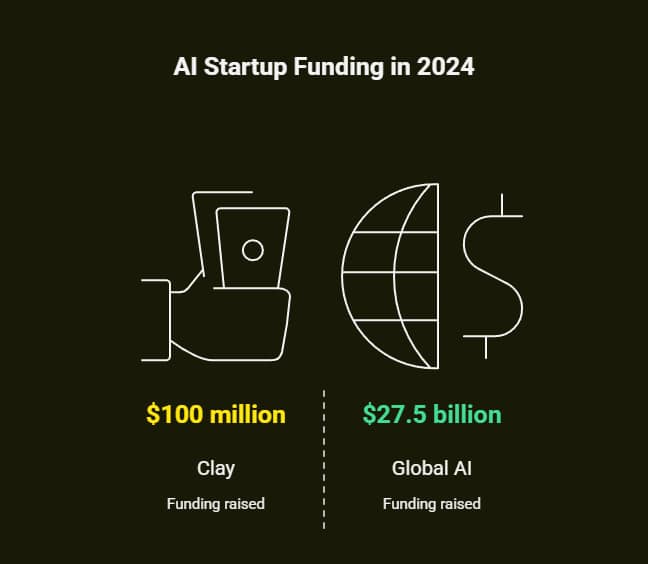

Recent funding rounds show that investors really want AI agent companies. Clay, an AI-driven personalized marketing platform, raised $100 million at a $3.1 billion valuation, showing institutional confidence in AI agent technologies.

Global funding in AI startups has reached $27.5 billion in 2024, and a large share is on agent-based. There’s promise for growth for early-stage investors with higher risk profiles.

Due Diligence Considerations

When I consider AI agent startups to invest in, I look for:

Technical Differentiation

The startup should show obvious technological benefits over existing solutions. While conducting due diligence, I examine algorithms, training methods, and performance measures.

Market Timing

The target market must be ready for AI agent adoption. I take a look at customer pain points, limitations of existing solutions, and the level of market education to assess if the timing is right.

Team Capabilities

AI agent firms need a mix of professionals who specialize in machine learning, software engineering, and the industry. I evaluate team backgrounds and track records carefully.

Scalability Architecture

For scaling the solution faster, the cost should not increase proportionally. I look at the technical architecture and unit economics for scalability aspects.

Risk Management and Portfolio Construction

Investing in AI agents is promising yet risky. From my investing experience, I’ve learned a few ways to construct AI agent portfolios.

Diversification Strategies

Sector Diversification

To reduce concentration risk, distribute your investments into various applications of AI agents like customer service, financial analysis, and more.

Stage Diversification

Diversifying your investments in the growth and dilutive stages, such as Microsoft and Google, is a good idea.

Geographic Diversification

Incorporate the experience of both U.S. and international AI development, especially since China has rapidly advanced its capabilities.

Timing Considerations

The AI agent space is extremely volatile owing to technological advancements, regulatory changes, and market sentiments. Using dollar-cost averaging has worked well for me to deal with entry timing risk.

According to recent market studies, the AI agent sector goes through boom and consolidation cycles. Knowing the cycles helps you make better entries and exits.

Industry-Specific Investment Opportunities

The potential for investing in AI agents varies across sectors due to adoption, regulations, and staffing needs.

Financial Services: Leading Adoption

This blog highlights that the financial sector leads AI agent adoption, with 65% of organizations using AI regularly, nearly double the proportion from ten months ago. This presents multiple investment angles.

Fraud Detection Agents

AI agents tracking transactions for irregularities or fraud command premium valuations due to clear ROI.

Algorithmic Trading Platforms

Retail and institutional investors are putting more money into investment platforms powered by AI agents.

Compliance Automation

Financial institutions are facing huge issues at present, and an AI agent can solve these issues.

Healthcare: Emerging Opportunities

Healthcare AI agents show tremendous promise, with the FDA approving 223 AI-enabled medical devices in 2023, up from just six in 2015, as reported here. Investment opportunities include.

Diagnostic Assistance

AI bots that help doctors analyze medical images and patient information make for a billion-dollar market.

Administrative Automation

AI agents scheduling appointments, verifying insurance, and communicating with patients drastically reduce costs.

Drug Discovery

AI agents speeding up drug R&D could lead to huge returns, albeit with longer development timelines.

Manufacturing: Automation Revolution

Manufacturers are using more and more AI agents for things like predictive maintenance and quality control. There are software platforms and integrated solutions we can invest in.

Future Trends and Emerging Opportunities

The AI agent landscape continues to evolve quickly, creating new investment opportunities. I have observed a number of trends that merit your attention.

Multi-Agent Systems

AI agents will team up in networks to solve complex issues of the future. Investing in companies that build orchestration systems for multi-agent systems can be profitable.

Edge AI Deployment

AI agents used in edge devices processing data in real time offer immense potential in autonomous vehicles, manufacturing, and IoT.

Regulatory Technology

The growing adoption of AI agents is likely to drive demand for tools and services to govern and ensure compliance of AI agents, keeping risk in check.

How to Invest in AI Agents: Crafting Your Investment Strategy

To successfully invest in AI agents, you need a method that balances growth with risk. From my experience, I would recommend this framework.

Phase 1: Foundation Building

Microsoft, Google, Amazon, and Salesforce, for example, already have these capabilities. They offer stable exposure to the growth in the market with lower volatility.

Use 40–60% of your AI agents’ allocation to these core holdings. These are companies that already generate revenues from AI.

Phase 2: Growth Opportunities

Add exposure to pure-play AI companies and platforms showing business traction. Specialized AI agent platforms, tailored industry solutions, or emerging tech might qualify.

Invest 20-30% in growth assets, tolerating higher volatility for greater returns.

Phase 3: Speculation and Innovation

For accredited investors, set aside 10-20% of your income to early-stage investments like VC funds, crypto tokens, and an AI agent you can develop.

You should only use money you can afford to lose in this allocation, as an early-stage investment is very risky.

Phase 4: Active Participation

Think about making and selling your own AI agents if you have technical abilities or can get developers as partners. This has the greatest profit potential but calls for active management and expertise.

In the beginning, you can opt for simple automated solutions for a small business. Later on, you can take up sophisticated business apps for enterprise usage for a profitable marketplace and firm through your earlier experience.

The AI agent revolution is one of the most important technological revolutions of our age. As time goes by, the barriers for entry are getting more lenient alongside the continuously expanding applications. Recently, however, the latest browser-based agents like Operator at OpenAI, and the autonomous multi-domain capabilities at Chinese startup Manus, show how far we are in playing out possibilities.

Investors are acting smarter nowadays, as the mass adoption would mark the valuation to a level that will hinder future returns. If you’re ready for autonomous intelligence, you can seize this opportunity by making an equity investment in AI companies, getting exposure to AI crypto, or building your own AI agent business. The real question is not if AI agents are going to disrupt your business, but if you will benefit from it.